what is the capital gains tax in florida

Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet. The Combined Rate accounts for the Federal capital gains.

8 Pro Tips On How To Avoid Capital Gains Tax On Property Florida Independent

Taxes capital gains as income and the rate reaches 45.

. Capital gains taxes on assets held for a year or less correspond to ordinary income tax brackets. What taxes do you pay when you sell a house in Florida. Generally speaking capital gains taxes are around 15 percent for US.

It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. Consequently what is the capital gains tax rate in Florida. Taxes capital gains as income and.

Capital gains are treated. Long-term capital gains tax is a tax applied to assets held for more than a year. Federal long-term capital gain rates.

Taxes on Long-Term Capital Gains. What is the capital gains tax rate for 2021 in Florida. The schedule goes as follows.

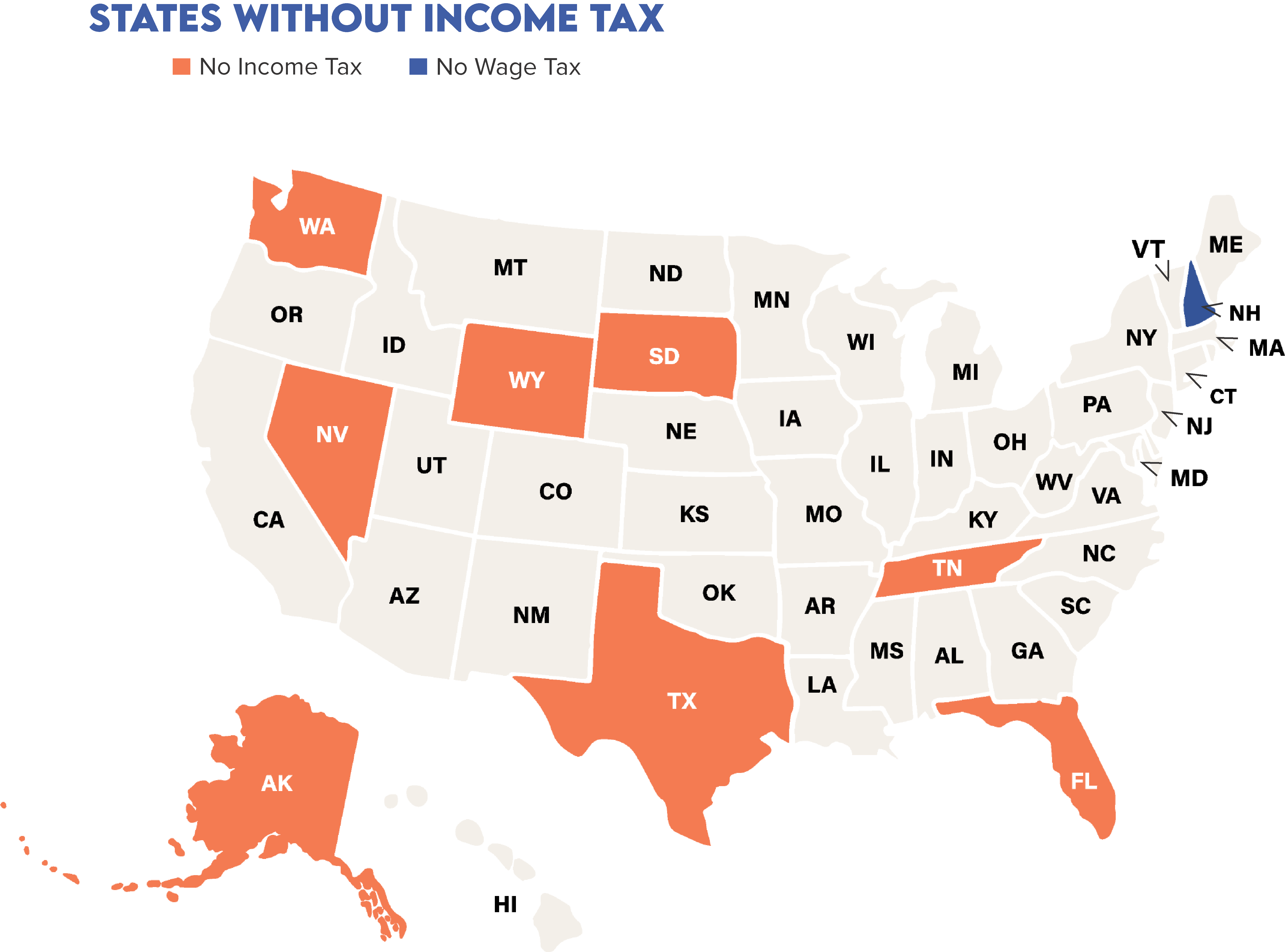

The State of Florida does not have an income tax. Residents living in the state of Florida though there are. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the.

Theyre taxed at lower rates than short-term capital gains. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. Florida does not have state or local capital gains taxes.

Long-term capital gains tax is a tax applied to assets held for more than a year. The long-term capital gains tax rates are 0. For example you inherited a house worth 500000 and kept it for 5 years.

Long-term capital gains on the other hand are taxed at either 0 15 of 20. Therefore youll have to pay capital gains from. If you are in the 25 28 33 or 35 bracket your long-term capital gains rate is 15.

What You Need To Know 2022. Special Real Estate Exemptions for Capital Gains. During this time the value of the property increased by 100000.

Ncome up to 40400. If you are in the 396 bracket your. A hike in capital gains tax rates to equalise them with income taxes had been mooted but Hunt has instead opted to hack back the tax-free allowance and halved it from.

What is the capital gain tax for 2020. There is no Florida capital gains tax on individuals at the state level and no state income tax. The long-term capital gains tax rates are 0.

That tax is paid to the local Florida. Florida does not have state or local capital gains taxes. Florida does not have state or local capital gains taxes.

Individuals and families must pay the following capital gains taxes. Long-term capital gains are gains on assets you hold for more than one year. Its called the 2 out of 5 year rule.

The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Taxes capital gains as income and the rate reaches 5. The Combined Rate accounts for the Federal capital gains.

The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations. The capital gains tax is a tax on money earned from investments rather than from wages or salary which are generally subject to income tax. Florida does not have state or local capital gains taxes.

The rate you receive will depending on your total gains earned. What is the capital gain tax for 2020. What is the capital gains tax rate for 2021 in Florida.

Heres an example of how much capital gains tax. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the. All properties in Florida are assessed a taxable value and owners are responsible to pay annual property taxes based on that value.

Short Term And Long Term Capital Gains Tax Rates By Income

Capital Gains Tax In The United States Wikipedia

How Do State And Local Individual Income Taxes Work Tax Policy Center

Guide To The Florida Capital Gains Tax Smartasset

Capital Gains Tax Meaning Types Ltcg Stcg Tax Rates How To Save Tax On Capital Gains

12 Ways To Beat Capital Gains Tax In The Age Of Trump

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Manuel Transferred His Commercial Land With A Cost Of P500000 But With A Fair Course Hero

The Flight To Tax Free States Investor Tax Advantages

Short Term And Long Term Capital Gains Tax Rates By Income

Here S How Stock Trading Profits Are Taxed Money

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Avoid Capital Gains Tax On Inherited Property Law Offices Of Daniel Hunt

As Democrats Float Higher Taxes On The Wealthy Hedge Fund Ceo Asks Florida Or Texas Yankee Institute

Guide To The Florida Capital Gains Tax Smartasset

U S President George W Bush Finishes His Jog At The Longboat Key Golf Club As Reporters Ask Him Questions About A Capital Gains Tax Cut In Long Boat Key Florida September 11

Selling Property In Florida As A Non Resident