santa ana tax rate

Identify a Letter or Notice. The current total local sales tax rate in Santa Ana Pueblo NM is 63750.

Sales Tax In Orange County Enjoy Oc

This is the total of state county and city sales tax rates.

. The 925 sales tax rate in Santa Ana consists of 6 California state sales tax 025 Orange County sales tax 15 Santa Ana tax and 15. 1788 rows Find Your Tax Rate. The 925 sales tax rate in Santa Ana consists of 6 California state sales tax 025 Orange County sales tax 15 Santa Ana tax and 15 Special tax.

Santa Ana Pueblo 1 29-951. Request an Extension or Relief. Total State plus Federal Excise.

Your bracket depends on your taxable income and filing status. Register for a Permit License or Account. The New Mexico sales tax rate is currently.

Santa Ana Pueblo 2 29-952. 10 12 22 24 32 35 and 37. The Santa Ana sales tax rate is.

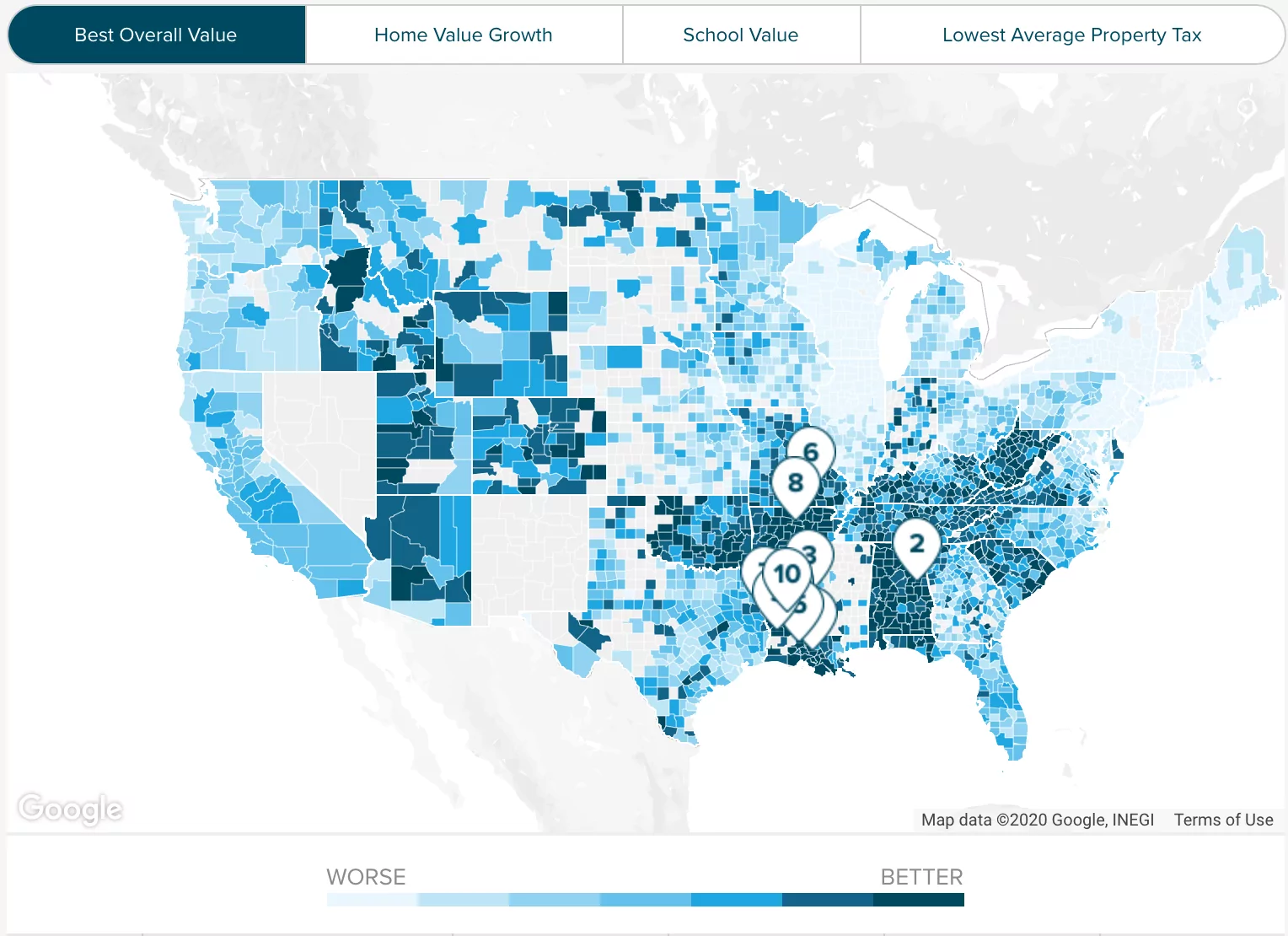

The median property tax in Orange County California is 3404 per year for a home worth the median value of 607900. The budgettax rate-determining process usually gives rise to customary public hearings to discuss tax rates and related budgetary questions. In the city limits of Las Cruces.

The December 2020 total local sales tax rate was also 63750. In the city limits of Las Cruces at 2021 residential tax rate of. Calculate Total Taxes Owed.

A combined city and county sales tax rate of 175 on top of Californias 6 base makes Santa Ana one of the more expensive cities to shop in with 1117 out of 1782 cities having a sales tax. The average cumulative sales tax rate in Santa Ana California is 925. The minimum combined 2022 sales tax rate for Santa Ana Pue New Mexico is.

This includes the sales tax rates on the state county city and special levels. Santa Ana is located within Orange. The following chart shows average annual property tax rates for each Orange County city for a 3-bedroom.

These are the rates for. In California your property tax rate may differ. This is the total of state county and city sales tax rates.

2020-2021 index to tax rate by citiesdistrict alphabetic list of cities and districts contained in tax rate area listings. As we all know there are different sales tax rates from state to city to your area and everything combined is the required. There is a maximum tax rate of ten cents for each 1 of dispensary proceeds and if cultivaton is allowed an annual maximum tax rate of 25 per square foot.

Method to calculate Santa Ana sales tax in 2021. Santa Ana must adhere to provisions of the California Constitution in levying tax. The median home value in Santa Ana the county seat in Orange County is 455300 and the median property tax payment is 2943.

Historical Tax Rates in California Cities Counties. The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. Net Taxable Value Mil Rate.

Business License Tax Fee Schedule Variable Flat Rate ENG. 025 lower than the maximum sales tax in CA. Keep in mind that under state law.

What is the sales tax rate in Santa Ana California. The Santa Ana sales tax rate is. The minimum combined 2022 sales tax rate for Santa Ana California is.

There are seven federal tax brackets for the 2020 tax year. See reviews photos directions phone numbers and more for the best Taxes-Consultants Representatives in Santa Ana CA. The Santa Ana sales tax rate is.

California state tax rates. Orange County collects on average 056 of a propertys assessed. Santa Ana has a Medical.

The December 2020 total local sales tax rate was also 63750. Which Orange County CA cities have the lowest and highest property tax rates. Net Taxable Value Mil Rate.

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

How Much Tax Do You Pay When You Sell Your House In California Property Escape

Who Pays The Transfer Tax In Orange County California

Pdf Unemployment Growth And Taxation In Industrial Countries

Orange County Ca Property Tax Calculator Smartasset

Food And Sales Tax 2020 In California Heather

The Poorest 20 Percent Of The Population End Up Paying Double State Tax Rate As The Top 1 Percent Institute Of Tax And Economi State Tax Income Family Income

Orange County Ca Property Tax Calculator Smartasset

California Sales Tax Guide For Businesses

A Golden Opportunity California S Budget Crisis Offers A Chance To Fix A Broken Tax System Tax Foundation

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

California Sales Tax Rates By City County 2022